POW Banker EA Review – A Smart Trading Algorithm for Forex Investors

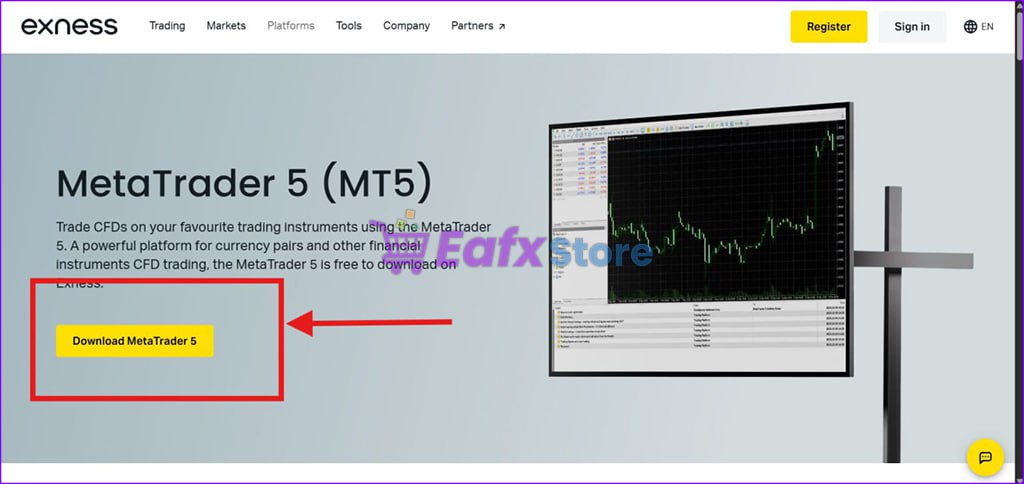

The POW Banker EA is a powerful, fully automated MetaTrader 5 trading robot designed for professional traders looking for consistency in the forex market. With a sophisticated trade sequencing strategy, dynamic risk management, and advanced technical indicators, this EA is tailored for traders who demand precision and efficiency.

Key Features of POW Banker EA

- Platform: MetaTrader 5 (MT5)

- Broker Compatibility: Works with major forex brokers supporting MT5

- Leverage: 1:1000 (adjustable)

- Strategy Type: Automated Trading with Trend & Ranging Market Adaptation

- Trade Direction: Long & Short

- Risk Management: Configurable stop-loss, take-profit, and drawdown limits

- Currency Pairs: Multi-pair support

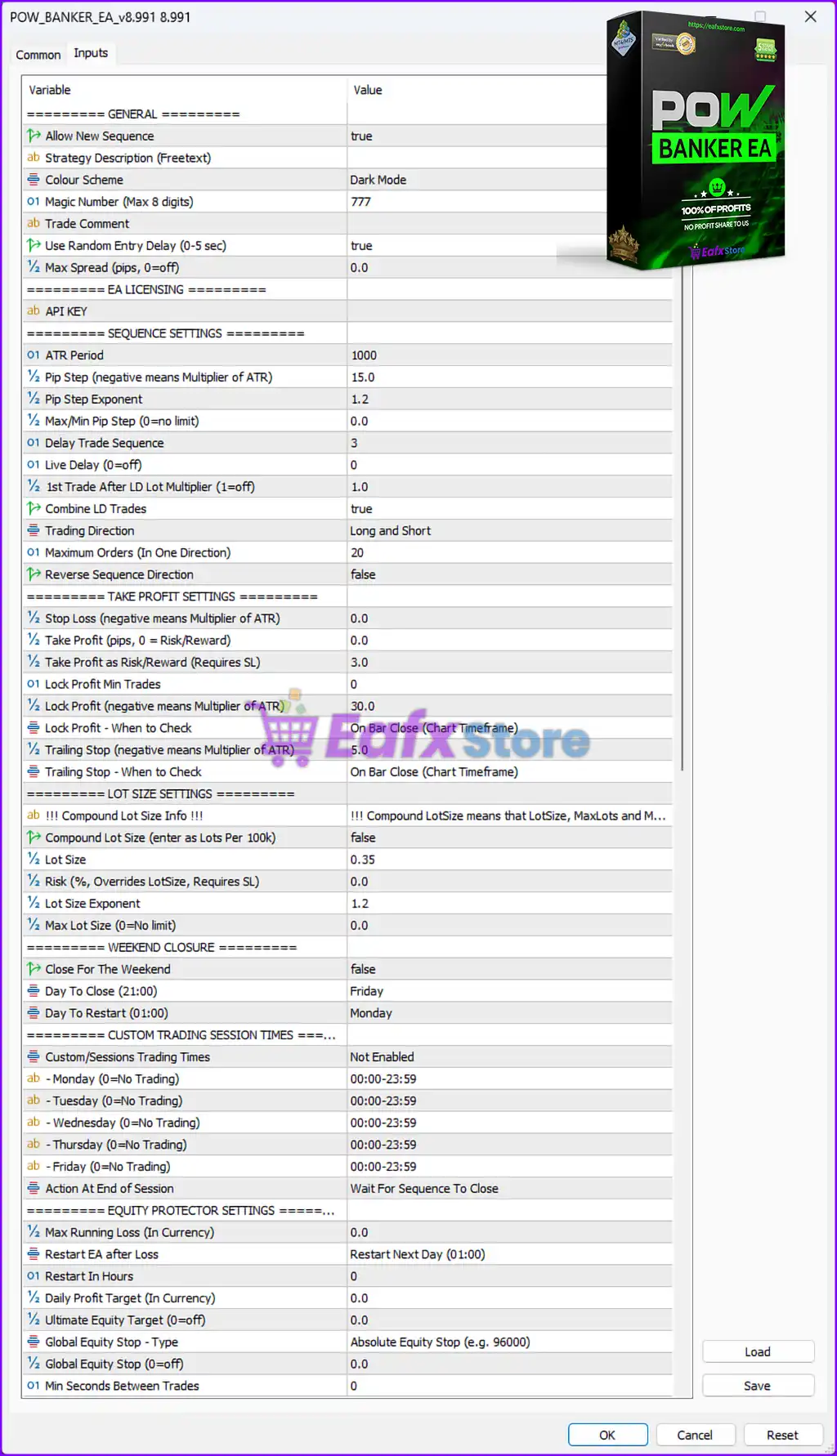

POW Banker EA Input Parameters Analysis

1. General Settings

- Allow New Sequence:

True→ The EA allows initiating new trade sequences. - Magic Number:

777→ A unique identifier to differentiate trades from other EAs. - Trade Comment: Customizable field to track EA-based trades.

- Use Random Entry Delay:

True→ Adds randomness to prevent broker detection. - Max Spread:

0.0→ Disables spread limit, meaning it executes trades regardless of spread conditions.

2. Trade Sequencing Settings

- ATR Period:

1000→ Measures market volatility for trade placement. - Pip Step Multiplier:

15.0→ Determines spacing between trades based on volatility. - Pip Step Exponent:

1.2→ Adjusts trade placement dynamically. - Delay Trade Sequence:

3→ Introduces a delay in order execution. - Maximum Orders:

20→ Limits the number of simultaneous trades.

3. Take-Profit & Stop-Loss Settings

- Stop Loss Multiplier:

0.0→ No fixed stop loss (relies on alternative risk control). - Take Profit in Pips:

0.0→ Uses risk/reward settings instead of fixed TP. - Take Profit Risk/Reward Ratio:

3.0→ Targets three times the risk. - Trailing Stop ATR Multiplier:

5.0→ Adjusts stop-loss dynamically. - Lock Profit Multiplier:

30.0→ Locks in profits after a predefined gain.

4. Lot Size & Risk Management

- Lot Size:

0.35→ Initial trade size. - Lot Size Exponent:

1.2→ Increases lot size progressively. - Risk Percentage:

0.0→ Uses a fixed lot instead of a percentage-based risk. - Max Lot Size:

0.0→ No cap on lot size.

5. Weekend Closure & Trading Sessions

- Close for Weekend:

False→ Trades remain open during weekends. - Custom Trading Sessions: Not Enabled → EA trades throughout the week.

- Trading Hours: 00:00 – 23:59 (Monday-Friday) → 24/5 operation.

6. Equity Protection & Recovery System

- Max Running Loss:

0.0→ No preset equity loss limit. - Restart EA After Loss:

Restart Next Day (01:00)→ Ensures automated recovery. - Daily Profit Target:

0.0→ No fixed daily target. - Ultimate Equity Target:

0.0→ No predefined target for account growth. - Global Equity Stop:

0.0→ No automated equity stop.

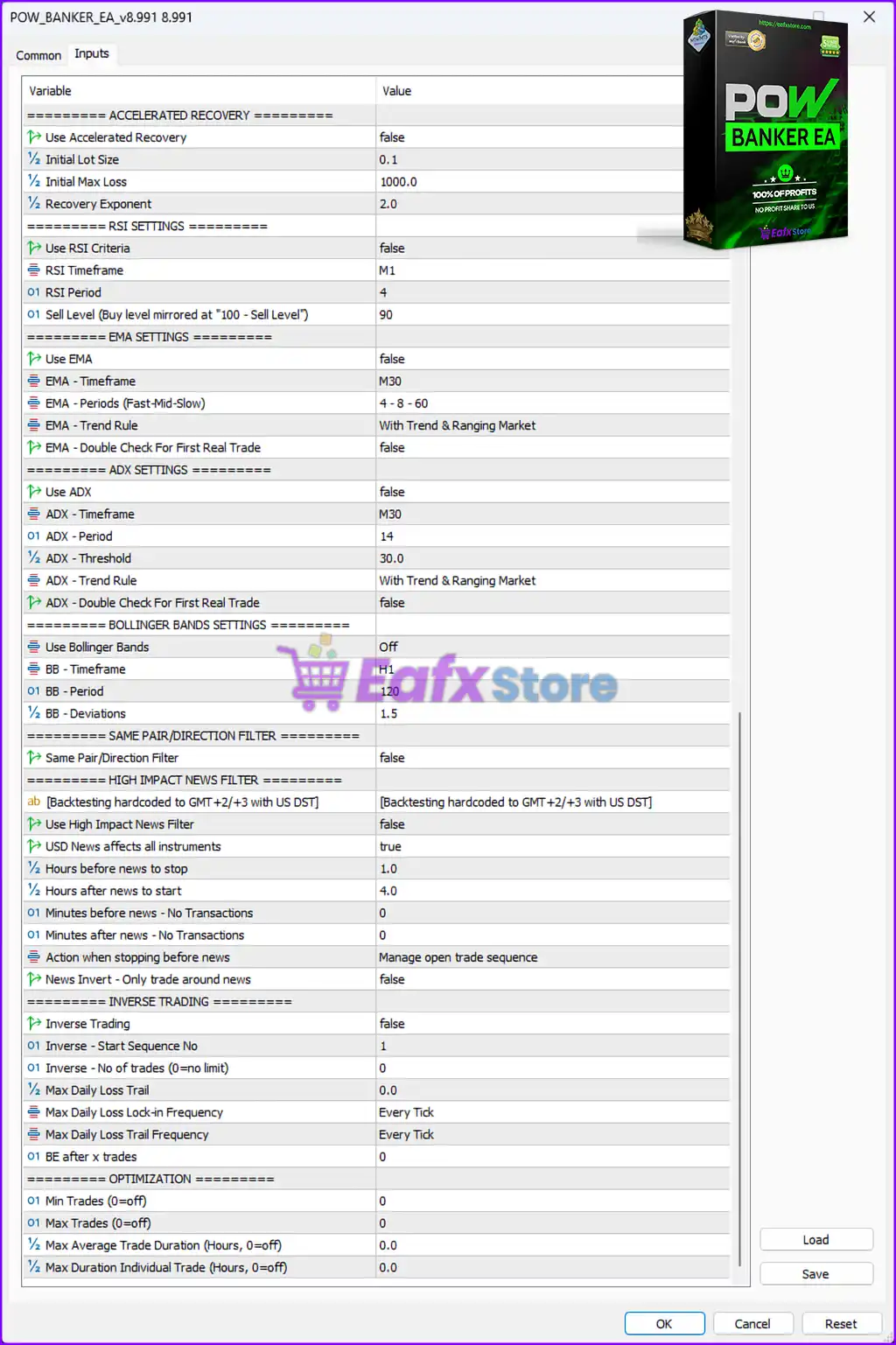

7. Technical Indicator Filters

- Use RSI:

False→ RSI filtering is not enabled. - EMA Trend Strategy:

Enabled→ Uses Exponential Moving Average for trend detection. - ADX Threshold:

30.0→ Determines trend strength for trade entries. - Use Bollinger Bands:

Off→ Bollinger Bands are not used for trading.

8. High-Impact News Filter

- Use News Filter:

False→ The EA does not avoid trading during news events. - USD News Impact:

True→ Monitors USD-related news but does not pause trading. - Hours Before News to Stop Trading:

1.0→ Stops trading 1 hour before news events.

9. Inverse Trading & Optimization

- Inverse Trading:

False→ Does not open opposite trades in case of drawdown. - Max Daily Loss Trail:

0.0→ No trailing stop for daily loss. - Trade Duration Limits: Disabled.

Performance Insights of POW Banker EA

✔ Profit Potential: The EA follows a structured approach with a 3:1 risk-reward ratio.

✔ Risk Management: Offers automated lot sizing and ATR-based stop-loss settings.

✔ Scalability: Supports multi-pair trading and grid-based sequencing.

✔ Market Adaptability: Uses EMA, ADX, and trend-following rules for optimal positioning.

Final Verdict: Should You Use POW Banker EA?

✅ Best For: Traders looking for an automated EA with customizable risk and profit settings.

✅ Key Advantage: ATR-based dynamic trade management prevents market overexposure.

✅ Limitations: No built-in news filter, meaning high-volatility events can affect performance.

👉 Conclusion: The POW Banker EA is a robust trading bot suitable for traders who prefer automated grid strategies with risk-adjusted lot sizing and take-profit settings. However, to maximize its efficiency, traders should monitor high-impact news and adjust parameters accordingly.

Leave a comment